MeitY Startup Hub onboards MergerDomo to strengthen start-up ecosystem in India

New opportunities await in the new year. Our goal at MergerDomo is to provide higher value to our corporate clients, startups, and investors.

Our first deal of the year was for an amount of USD 1 million, where we facilitated a pre-Series A funding round for Cloud Tailor , along with India Discovery Fund from 35 North Venture on our platform. We are also thrilled to announce the investment of MergerDomo in Cloud Tailor!

Cloud Tailor is a D2C platform that enables personalized women’s fashion. It aims at providing online tailoring solutions for ethnic as well as western clothing to women.

We hope to facilitate larger transactions for our registered businesses with the fastest turn-around times possible

I wish each of you a year of stability, success, and professional fulfillment. We look forward to contributing to your business growth and being a part of your journey.

Presenting MergerDomo’s Thought Corner, where our team of analysts present their opinions and views on the most significant developments relating to Business & Finance.

Debt or Equity: What’s at Stake?

When it comes to raising capital for your business, the most familiar route may not be the best one. Small and medium enterprises (SME) have long relied on debt over equity financing, though the challenges associated with it often outweigh the benefits.

Debt and equity are two broad means of raising capital for companies. Most companies have both forms of funding on their balance sheets, albeit in different proportions. No two businesses are alike, and their financing decisions depend upon factors such as stability of cash flow, willingness to give up ownership and target debt equity.

SMEs have a strong affinity towards internal accruals, followed by debt finance to meet their funding requirements. External equity has been the least popular option. This is in spite of the fact that there is an estimated credit gap of USD 300 billion in this sector. A major reason behind the unwillingness to enter the equity market is poor financial literacy.

| Type of Funding | Pros | Cons |

|---|---|---|

| Debt |

|

|

| Equity |

|

|

https://www.smefinanceforum.org/post/promoting-access-to-digital-marketplaces-for-smes-in-india

Domestic fabless players to get support via design-linked incentive

By Jairaj Srinivas Founder & DG Confederation of Indian MSME in ESDM & IT

The Union Cabinet has cleared a comprehensive Rs 76,000-crore ($10-billion) package to build a much-needed semiconductor ecosystem in the country. The incentives will be extended to a range of new units - greenfield chip fab and display fab units, apart from compound semiconductor and ATMP (assembly, testing, marking, and packaging) facilities. The package also gives a fiscal push to the fledgling homegrown semiconductor product design companies (fabless players). Backing this effort is support to universities to train 85,000 engineers under the “chips to start-ups” programme.

Semiconductor and display fab units under the scheme will offer financial support of up to 50% of the project cost. This will be given to eligible players that have the technology, as well as the capacity to execute such high capital and resource incentive projects. The government is targeting the setting up of two semiconductors, as well as display fab units. To encourage the setting up of compound semiconductor units (which make chips that are used in mobile chargers, electric vehicles, and telecom radios) and ATMP (assembly, testing, marking, and packaging) facilities, the government will offer fiscal support of up to 30% of capital expenditure to the approved units. The government expects over 15 such units to come up in this space.

Mr. Ashwini Vaishnaw, Communications and Electronics & IT minister, said that the policy will attract potential global players and the incentives are better than other competing countries, such as South Korea, the US, and Taiwan to setup fab plants. “The large available design ecosystem in India will be the greatest advantage. We already have 25,000 design engineers in India. We will be giving 50 percent capital incentive for semiconductor fab and display fab a similar incentive which is at par with the global market. The Indian policy is offering something extra - a clear 20-year roadmap for generating and nurturing talent and making sure that as the industry grows, there is a sufficient number of the required talent.”

CIMEI the PAN India Tradebody welcomes the package. We feel that in less than a decade, a new era in electronics manufacturing will form a vital pillar of the government’s Atamanirbhar Bharat vision, in addition to driving growth and innovation, increased job creation and will address the global supply chain crisis.

The DG CIMEI says, "We have already initiated a consortium to build a strong Components Manufacturing Ecosystem. We are confident that such an announcement will strengthen our commitment towards the Ecosystem. This will enable India to become an electronics hub and encourage corporates to start manufacturing in India. It is a big step to bring India on the world map of the semiconductor industry as it will pave the path for the industry to broaden the horizon of research, manufacturing and export. In the long term, issues like a sudden surge in demand for semiconductors will also be addressed. This move will also make the Indian manufacturers globally competitive to attract investment in the areas of core competency and cutting-edge technology.”

The Large part of the government funding will go towards setting up fab and fab display plants. According to estimates, the investment required for an advanced technology chip plant (producing 28-nanometre chips and above) costs 3-4 billion USD in the US, while a modern fab display plant may need a $3-billion investment. With half the investment coming from the government, nearly 60 per cent of the package may be spent on funding these megaprojects. Another $2 billion will go towards funding compound semiconductor plants that require an investment of around $250 million each and OSAT (outsourced semiconductor assembly and test) operations.”

The package includes support to homegrown chip product design companies (fabless companies) that also sell the product by manufacturing it at third-party units. Under the design-linked incentive (DLI), product design-linked incentive of up to 50 per cent of eligible expenditure and product deployment-linked incentive of 4 percent-6 per cent on net sales for five years will be offered. The government is looking to offer this support to at least 100 domestic companies; Expecting at least 20 such companies to hit revenue of Rs 1,500 crore in next five years.

The new policy is the government’s regular attempt to create a semiconductor ecosystem in the country. In 2007, Intel showed interest but moved to China and Vietnam instead because the Indian government’s policy and incentives were not thought through. In 2013, the government approved two proposals, one by the Jaypee group with a promise to subsidize the project cost. The promoters failed to raise finances and the projects were aborted. Even now after this announcement Intel has announced plans to pour US$7 billion into building a new chip packaging facility in Penang, Malaysia. For many decades Intel has been enjoying special status in India by receiving various Financial, administrative and commercial benefits from India specially from state of Karnataka.

“While appreciating the Government commitment to promote Semiconductor FAB in India we feel that whole industry has only a few small players with total revenue of not more than $30 million. Designing a chipset is expensive and costs $2-10 million and venture funds don’t fund such industry. The government incentive will give a huge boost to grow our business.” Says Team CIMEI, “Indian chip design firms go to Taiwan to get their chip manufactured and costs are high.”

The government through its various expressions of interest floated late last year and this year to gauge interest from global players for fabs has already targeted chip manufacturers. They include Taiwanese majors Taiwan Semiconductor Manufacturing Company, VIA Technologies, and United Microelectronics Corporation, US giants Intel, Micron Technology, NXP Semiconductors, and Texas Instruments, Japanese players Fuji Electric and Panasonic, European chipmakers Infineon Technologies and STMicroelectronics, and South Korean SK HYNIX and Samsung. Domestic players like the Tatas and Vedanta have also been approached for OSAT and display fabs, according to sources.

The key to success is building the infrastructure -- abundant water and continuous power supply, and dust-free environment -- an area in which India needs to improve a lot.

Disclaimer: The information provided in this article is for general informational purposes only. All information is provided in good faith

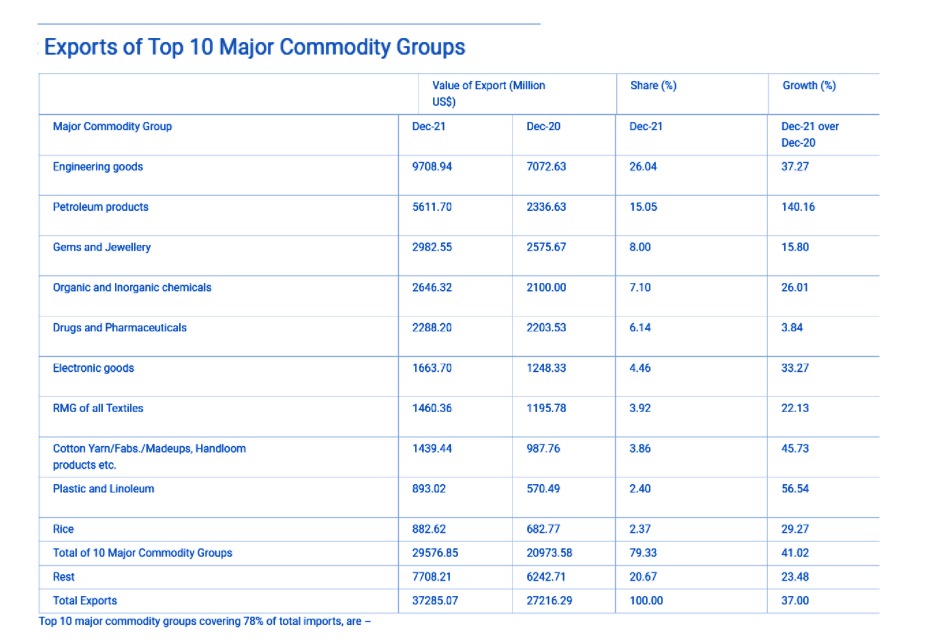

Export Import:- India’s merchandise export in April-December 2021 was USD 299.74 billion, an increase of 48.85% over USD 201.37 billion in April-December 2020 and an increase of 25.80% over USD 238.27 billion in April-December 2019

As per the Preliminary Data for December 2021, India’s merchandise export in December 2021 was USD 37.29 billion, the highest ever monthly achievement, which shows an increase of 37.0% over USD 27.22 billion in December 2020 and an increase of 37.55% over USD 27.11 billion in December 2019.

India’s merchandise export in April-December 2021 was USD 299.74 billion, an increase of 48.85% over USD 201.37 billion in April-December 2020 and an increase of 25.80% over USD 238.27 billion in April-December 2019.

India’s merchandise import in December 2021 was USD 59.27 billion, an increase of 38.06% over USD 42.93 billion in December 2020 and an increase of 49.7% over USD 39.59 billion in December 2019.

India’s Merchandise Trade in December 2021

Value of non-petroleum exports in December 2021 was 31.67 USD billion, registering a positive growth of 27.31% over non-petroleum exports of USD 24.88 billion in December 2020 and a positive growth of 34.92% over non-petroleum exports of USD 23.48 billion in December 2019.

Value of non-petroleum imports was USD 43.37 billion in December 2021 with a positive growth of 30.22% over non-petroleum imports of USD 33.31 billion in December 2020 and a positive growth of 50.20% over non-petroleum imports of USD 28.88 billion in December 2019.

Value of non-petroleum and non-gems and jewellery exports in December 2021 was USD 28.69 billion, registering a positive growth of 28.64% over non-petroleum and non-gems and jewellery exports of USD 22.30 billion in December 2020 and a positive growth of 36.21% over non-petroleum and non-gems and jewellery exports of USD 21.06 billion in December 2019.

Value of non-oil, non-GJ (gold, silver & Precious metals) imports was USD 35.57 billion in December 2021 with a positive growth of 34.68% over non-oil and non-GJ imports of USD 26.41 billion in December 2020 and a positive growth of 47.75% over non-oil and non-GJ imports of USD 24.07 billion in December 2019.

Merchandise Non-POL Trade in December 2021

The cumulative value of non-petroleum and non-gems and jewellery exports in April-December 2021 was USD 228.25 billion, an increase of 36.66% over cumulative value of non-petroleum and non-gems and jewellery exports of USD 167.02 billion in April-December 2020 and an increase of 28.12% over cumulative value of non-petroleum and non-gems and jewellery exports of USD 178.15 billion in April-December 2019.

Non-oil, non-GJ (Gold, Silver & Precious Metals) imports was USD 263.66 billion in April-December 2021, recording a positive growth of 47.33%, as compared to non-oil and non-GJ imports of USD 178.96 billion in April-December 2020 and a positive growth of 17.20% over USD 224.96 billion in April-December 2019.

*Exim Data-Ministry of Finance Top 10 major commodity groups covering 79% of total exports and showing positive growths in December 2021 over corresponding month of previous year.

|

Sector

|

Deal Type

|

Description

|

Deal Size

(In Mn) |

Link

|

|---|---|---|---|---|

|

Energy and environmental

|

Buy Side Acquisition

|

An Energy and Environmental (Solar Power Generation (Renewable)) entity is looking for strategic investment opportunities in solar farm power generation

|

USD 5

|

|

|

Information and Communications Technology-ICT

|

Buy Side Acquisition

|

An Information and Communications Technology-ICT (IT Consulting) entity from India is looking for strategic investment opportunities in India

|

USD 2 - 5

|

|

|

Hospital and healthcare

|

Sell Side Acquisition

|

Hospitals and Healthcare (Telemedicine) entity from Singapore is looking to sell out

|

USD 3.5 - 4

|

|

|

Pharmaceuticals

|

Sell Side Acquisition

|

A Pharmaceuticals (Bulk Drug manufacturing) entity from India is looking to sell out

|

USD 9.34 - 10.68

|

|

|

Financial Services

|

Sell Side Acquisition

|

A Financial Services (Banking & Capital Markets) entity from India is looking to sell out

|

USD 13.35

|

|

|

Pharmaceuticals

|

Sell Side Acquisition

|

A Pharmaceuticals (API) entity from India is looking to sell out

|

USD 100

|

|

|

Manufacturing

|

Buy Side Acquisition

|

A Manufacturing entity from India is looking for strategic investment opportunities in South East Asia

|

USD 14 - 15

|

|

|

Financial Services

|

Sell Side Acquisition

|

A Financial Services (Non Banking finance company) entity from India is looking to sell out

|

USD 15 - 20

|

| Sector | Energy and environmental |

|---|---|

| Deal Type | Buy Side Acquisition |

| Description | An Energy and Environmental (Solar Power Generation (Renewable)) entity is looking for strategic investment |

| Deal Size (In Mn) | USD 5 |

| View Deal | |

| Sector | Information and Communications Technology-ICT |

|---|---|

| Deal Type | Buy Side Acquisition |

| Description | An Information and Communications Technology-ICT (IT Consulting) entity from India is looking for strategic investment opportunities in India |

| Deal Size (In Mn) | USD 2 - 5 |

| View Deal | |

| Sector | Hospital and healthcare |

|---|---|

| Deal Type | Sell Side Acquisition |

| Description | Hospitals and Healthcare (Telemedicine) entity from Singapore is looking to sell out |

| Deal Size (In Mn) | USD 3.5 - 4 |

| View Deal | |

| Sector | Pharmaceuticals |

|---|---|

| Deal Type | Sell Side Acquisition |

| Description | A Pharmaceuticals (Bulk Drug manufacturing) entity from India is looking to sell out |

| Deal Size (In Mn) | USD 9.34 - 10.68 |

| View Deal | |

| Sector | Financial Services |

|---|---|

| Deal Type | Sell Side Acquisition |

| Description | A Financial Services (Banking & Capital Markets) entity from India is looking to sell out |

| Deal Size (In Mn) | USD 13.35 |

| View Deal | |

| Sector | Pharmaceuticals |

|---|---|

| Deal Type | Sell Side Acquisition |

| Description | A Pharmaceuticals (API) entity from India is looking to sell out |

| Deal Size (In Mn) | USD 100 |

| View Deal | |

| Sector | Manufacturing |

|---|---|

| Deal Type | Buy Side Acquisition |

| Description | A Manufacturing entity from India is looking for strategic investment opportunities in South East Asia |

| Deal Size (In Mn) | USD 14 - 15 |

| View Deal | |

| Sector | Financial Services |

|---|---|

| Deal Type | Sell Side Acquisition |

| Description | A Financial Services (Non Banking finance company) entity from India is looking to sell out |

| Deal Size (In Mn) | USD 15 - 20 |

| View Deal | |

Infinity Radar is the trade name for various products and services to serve law enforcement agencies and security agencies since 2017.

The company later on inspired by Prime Minister, Shri Narendra Modi’s initiative Start-up India and Make in India, started research and development in the sector of Electronic Warfare (EW) under the able leadership of the company’s Founder & CEO Mr. Himanshu P Dave and was incorporated as Infitron Advanced System Pvt. Ltd. (IASPL). Infitron Advanced Systems Pvt. Ltd. is recognized Defense start-up by Department for Promotion of Industry and Internal Trade and Department and Ministry of Electronics and Information Technology as Defense Start-up.

Debt or Equity: What’s at Stake?

Products and Services

Infinity Radar’s Product line includes:

Infinity Radar also provides research and development services in Microwave systems and related sub systems.

Please contact at the email address given below:

Disclaimer: Any information provided herein is indicative only, subject to change without notice, and does not constitute an offer to purchase or sell. The information contained in this electronic message and in any attachments to this message is confidential, legally privileged, and intended only for the person or entity to which this electronic message is addressed. If you are not the intended recipient, please notify the system manager, and you are hereby notified that any distribution, copying, review, retransmission, dissemination, or other use of this electronic transmission or the information contained in it is strictly prohibited.